Boss Nha Cai: Your Guide to Winning Big

Explore the latest tips and trends in online betting.

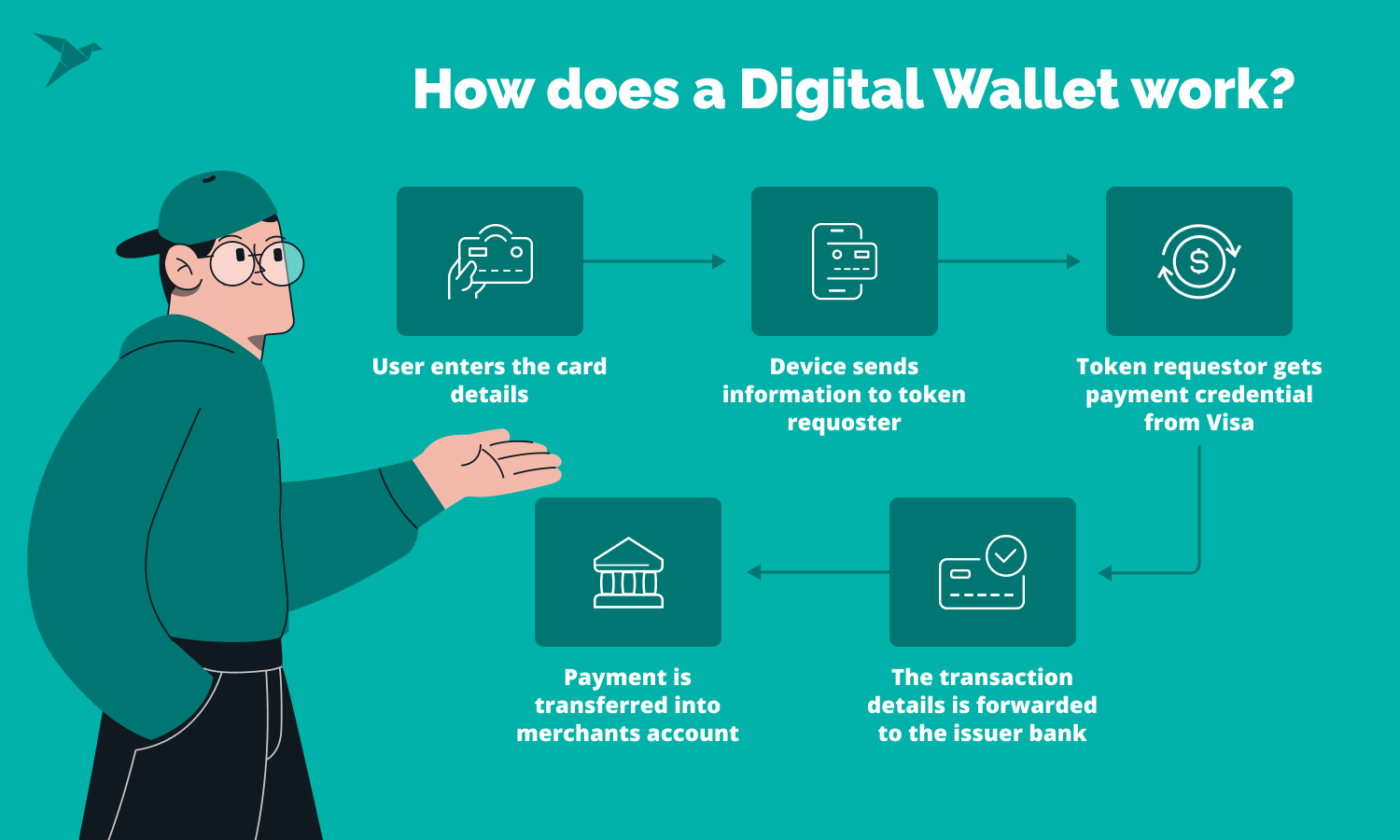

Going Cashless: The Quirky World of Digital Wallet Integrations

Explore the quirky realm of digital wallets! Discover how cashless innovations are transforming payments and your everyday life. Click to learn more!

Exploring the Advantages: Why Going Cashless is More Than Just a Trend

In recent years, the shift towards a cashless society has gained significant momentum, with more individuals and businesses embracing digital payments. The advantages of going cashless extend far beyond mere convenience; they encompass enhanced security, efficiency, and accessibility. By utilizing digital transactions, people can minimize the risk of theft and fraud, as electronic payments often come with built-in security features such as encryption and two-factor authentication. This shift not only protects consumers but also helps businesses streamline their operations, leading to a smoother transaction process and reduced handling of physical cash.

Furthermore, a cashless system promotes financial inclusion by making it easier for people to engage in economic activities. Mobile payment apps and digital wallets are designed to be user-friendly, allowing even those without traditional banking services to participate in the economy. For instance, marginalized communities can now access tools that enable them to make transactions, manage budgets, and save effectively. By embracing this trend, we can create a more inclusive financial landscape that empowers everyone, supporting the idea that going cashless is not just a temporary fad, but a transformative movement toward a more efficient and equitable financial future.

Counter-Strike is a popular tactical first-person shooter game where players compete in teams to complete objectives or eliminate the opposing team. With its strategic gameplay and competitive nature, players often seek ways to enhance their gaming experience, which is why many explore options like the betpanda promo code to gain extra benefits. The game has a rich history and has evolved through various iterations, becoming a staple in the esports community.

Digital Wallets Demystified: How Integrations Shape Our Spending Habits

Digital wallets have revolutionized the way we manage our finances, offering a seamless blend of convenience and security. As more consumers turn to these digital solutions for everyday purchases, it's crucial to understand how integrations with various platforms impact our spending habits. For instance, when a digital wallet syncs with budgeting apps, it empowers users to track their expenses in real-time, encouraging smarter financial decisions. Moreover, integration with loyalty programs allows users to earn rewards effortlessly, incentivizing them to spend more through their digital wallets.

As the ecosystem of digital wallets continues to evolve, we witness a shift in consumer behaviors. One significant change is the growing preference for contactless payments, which have transformed shopping experiences across retail environments. According to recent studies, approximately 70% of consumers are motivated to use digital wallets due to their ease of use and enhanced security measures. This behavioral shift highlights the importance of integrations that not only streamline transactions but also provide personalized offers and insights, further shaping how we approach our spending.

Is Your Business Ready for a Cashless Future? Essential Tips for Integration

As we navigate the rapid evolution of technology, it's clear that cashless transactions are not just a trend but a fundamental shift in how businesses operate. A cashless future offers several advantages, including improved efficiency, enhanced security, and greater customer convenience. To prepare for this transition, business owners should assess their current payment systems and identify areas for improvement. Essential tips include evaluating various payment processing solutions, ensuring you have the necessary hardware, and training your staff to handle electronic transactions smoothly.

Moreover, understanding your customer base is crucial in this transition. A cashless environment can enhance the overall customer experience, but it's important to consider their preferences regarding payment methods. Conducting surveys and gathering feedback can help shape your strategy and ensure you are meeting client expectations. Additionally, consider implementing loyalty programs that reward cashless transactions, as this can encourage adoption among hesitant customers. By taking a proactive approach and embracing a cashless future, your business can thrive in an increasingly digital economy.